This year, Europe is confronted with a critical double challenge: addressing the climate change issue and pulling itself out of a persistent low growth trap. Today these two challenges are addressed separately.

On the one hand, climate negotiations must reach a historical agreement in the Paris conference in December 2015. On the other hand, the Juncker Plan of 315 billion euros of investment, and above all the ECB announcement of a massive purchase of assets for an amount of around 1100 billion euros, must help to avoid a deflationary spiral and stimulate a new flow of investments.

Regarding climate policies, public regulators have essentially focused on a carbon price, which remains today at an insufficient level to trigger the financing needs of the low carbon transition.

The potential of the banking and saving channels (targets of the asset purchase program of the ECB) to scale up climate finance is however neglected.

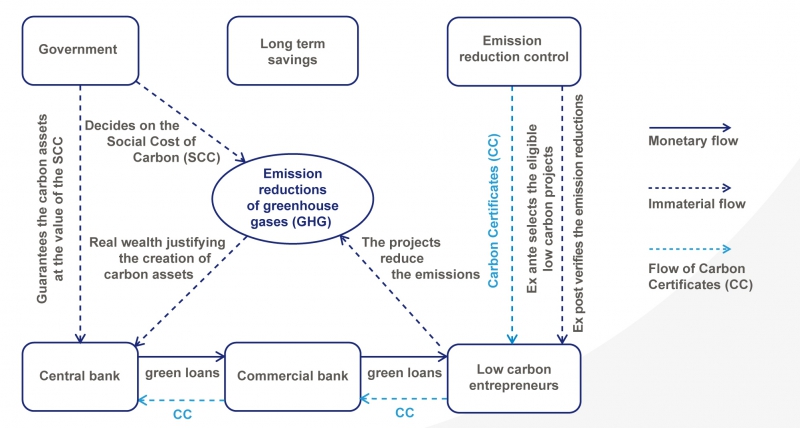

This Note d’analyse proposes to make private low-carbon assets eligible for the ECB asset purchase program. The carbon impact of these assets would benefit from a public guarantee that would value their carbon externality at a level sufficient to compensate the absence of an adequate carbon price. This mechanism would immediately impact the investment decisions of private actors with a positive effect on growth. It would also strongly incite governments to progressively implement carbon pricing tools to ensure that the public backing of the value of the carbon assets remains neutral with respect to public budgets.

A financial intermediation mechanism backed on a carbon value

Summary:

- Europe in 2015, at the crossroads of the climate and growth recovery challenges

- On the difficulties of carbon pricing

- Building a climate-friendly financial intermediation

- A monetary plan to fund the transition

Authors: Michel Aglietta, Scientific advisor at CEPII and France Stratégie ; Étienne Espagne, Economist at the Economy and Finance Department, France Stratégie ; Baptiste Perrissin Fabert, Climate Economist at Commissariat Général au Développement Durable, ministère de l’Écologie, du Développement durable et de l’Énergie