Policy brief

Policy Brief - The Levers of a European Investment Strategy

The investment gap that arose during the crisis partly explains the reduction of potential growth in European countries. It results in ageing of company equipment and infrastructures, in particular in the South of the Eurozone.

Published on : 14/11/2014

Temps de lecture

An increase in investment in Europe, as planned in the “Juncker package”, which provides for the mobilisation of 300 billion euros in investments, will have both a medium-term effect upon supply and a short-term effect upon demand, and therefore upon growth.

The choice of these investments needs to be guided by several objectives:

- selecting additional investments which would not have been implemented in the absence of European and national initiatives;

- avoiding projects with insufficient socioeconomic returns (of the “white elephant” kind, which prove more costly than beneficial) or based upon barely-stabilised technologies, which carry the risk of being imminently condemned to obsolescence;

- anticipating these investments when possible, that is to say to accelerate their implementation in order to obtain short-term effects for business (renovation and renewal of existing infrastructures for example).

National and European authorities have several roles to play:

- ensuring a certain stability of the fiscal and regulatory framework: this will give greater visibility to investors and, by means of regulation, also enable improved planning of devaluation of capital stock, therefore facilitating its renewal;

- mobilising public debt funds, capital holdings and guarantees, in order to “activate” private resources that are afraid of excessively high levels of risk;

- putting appropriate European governance into place for the selection of future projects.

These conditions will open the possibility of moving from a situation in which reduction of State debts is synonymous with weak investment and weak growth, to one in which debt reduction is enabled by strong growth, catalysed by large, high-quality capital stocks.

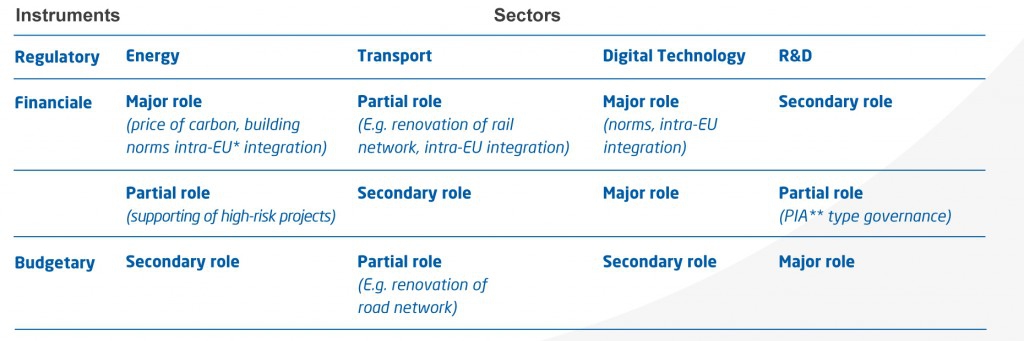

What actions in which sectors?

Summary: The Levers of a European Investment Strategy

- Reconciling short and medium-term effects

- Breaking down the barrier of uncertainties

- Conditions for the carrying of residual risk by the european union member states

- Public investment, a condition for growth and debt reduction

Authors: Fabien Dell and Nicolas Lorach, Economy and Finance Department

Téléchargement

Policy Brief - The Levers of a European Investment Strategy

Reference

More

Service national : construire un nouveau modèle français (et européen)

Face aux défis contemporains d’engagement citoyen, de cohésion nationale et de préparation à la défense, plusieurs pays en Europe ...

Note flash

05 May 2025

On overview of the conclusions drawn by the evaluation committee

The law on economic growth and activity (“Loi pour la croissance et l'activité”) is designed to create the conditions for a reboun...

23 February 2015

Central bank advocacy of structural reform: why and how?

Forthcoming in European Central Bank (2015), Inflation and Unemployment in Europe, Proceedings of the ECB Forum on Central Banking...

02 September 2015